.

Overview: BizEquity Business Valuation

BizEquity started as an online business valuation software intended for use directly by small business owners. The focus of our SaaS model took a hard pivot after realizing that business valuation was more desirable to advisors. These advisors became our primary focus for the software but we still wanted to serve the small business owners directly.

The problem to be solved: How can our valuation software best serve advisors as well as small business owners?

.

User Personas

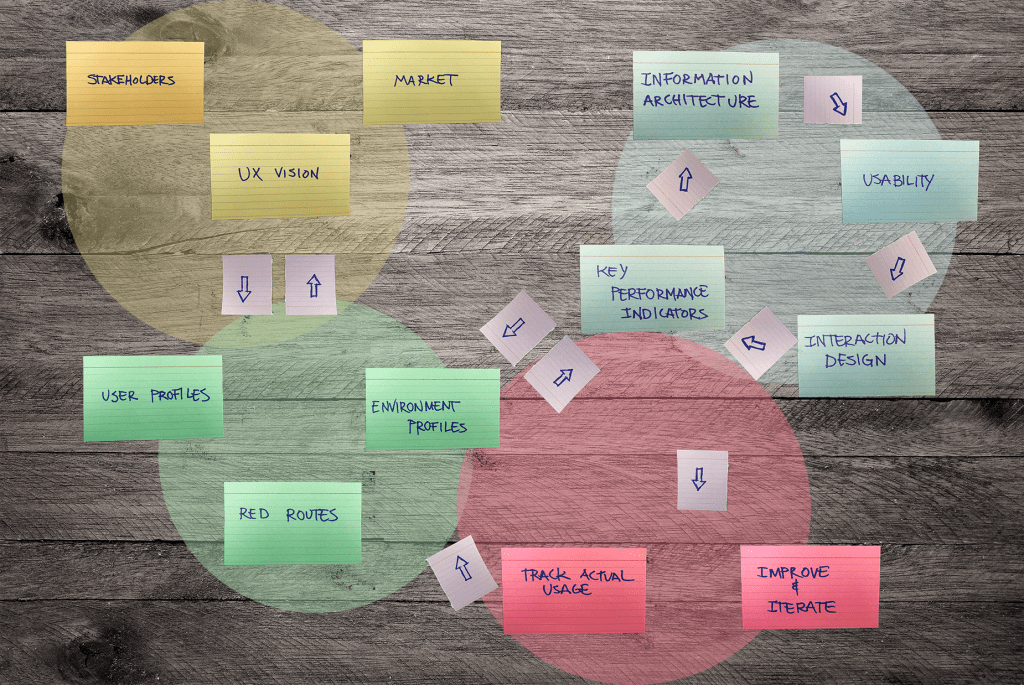

User personas were essential to addressing our particular problem. Wanting to serve two different bases created problems in both user experience and user perception. If the small business owner thought that we were just using their data to sell to advisors–they wouldn’t trust us with their information. For the advisors, we didn’t want cut them out of the process by providing our reports directly to the business owner for a cheaper cost.

User profiles were collected into two distinct groups: Advisors or Small Business Owners.

.

Discovery

Keeping our primary goal of serving divergent needs of our user base I did research with our current users. By tracking actual usage as well as soliciting feedback for desired features, I discovered what parts of the software were most useful for them and what processes were most effective for getting them a successful valuation.

The central question at hand: What features are used the most and have the greatest impact?

.

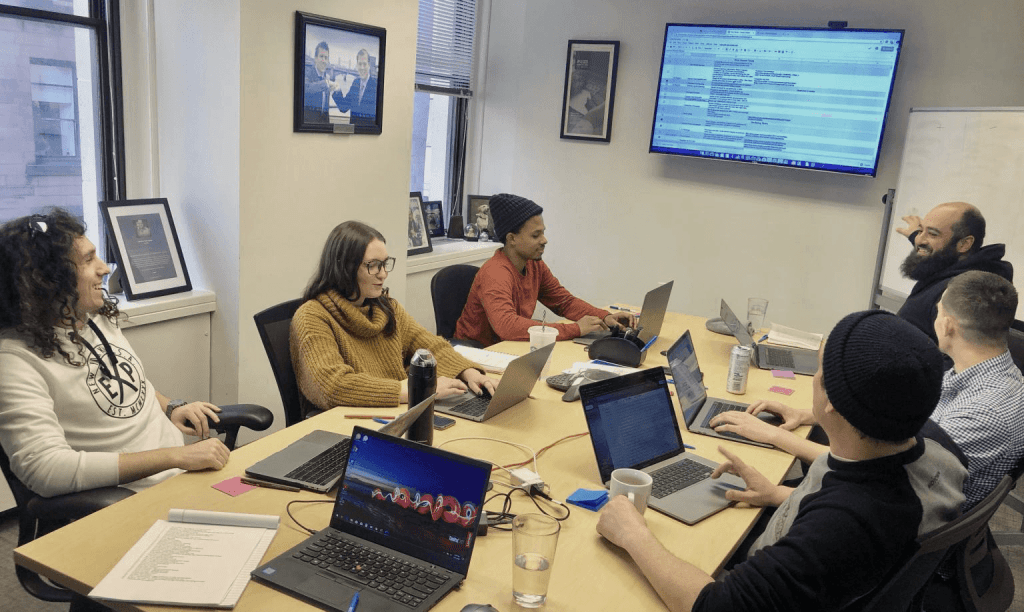

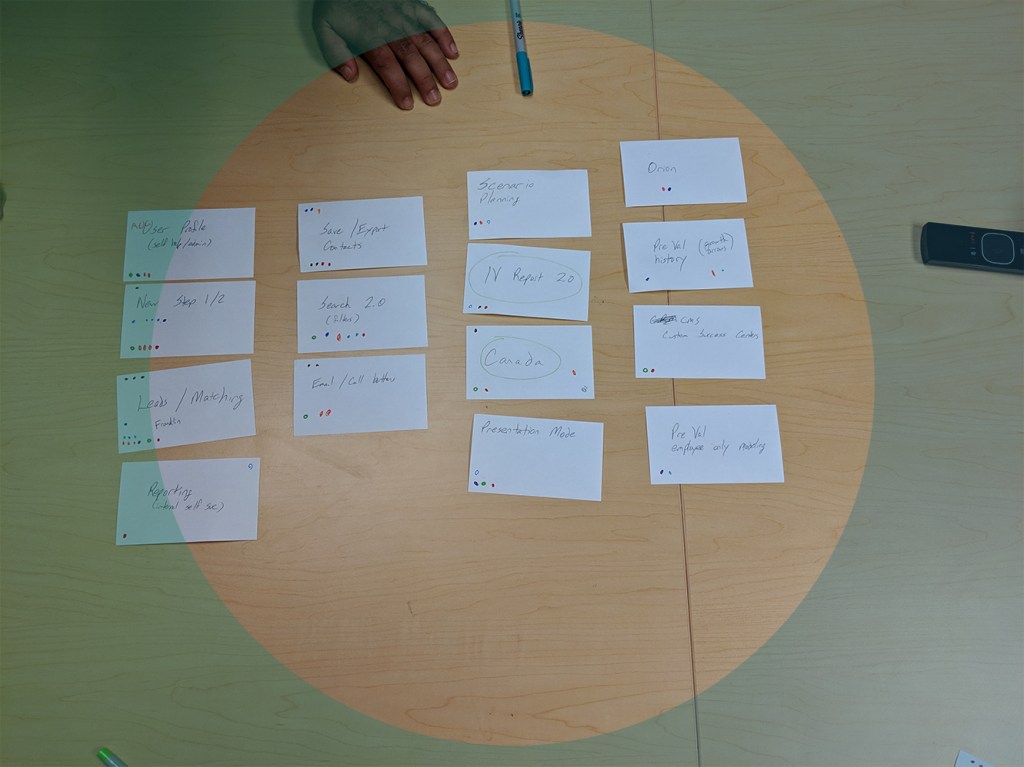

Prioritization

I broke the issues and processes into categories as perceived by the users and assigned priority based on the feedback from discovery across users and stakeholders. From this point we were able to move forward with what issues and features were most critical to solving the original problem of serving both advisors and small business owners.

Once priority was established I used sketching to explore the greater detail of each feature. This allowed for rapidly iterating through feedback that could quickly change as it was shared across the product, design, and development teams.

.

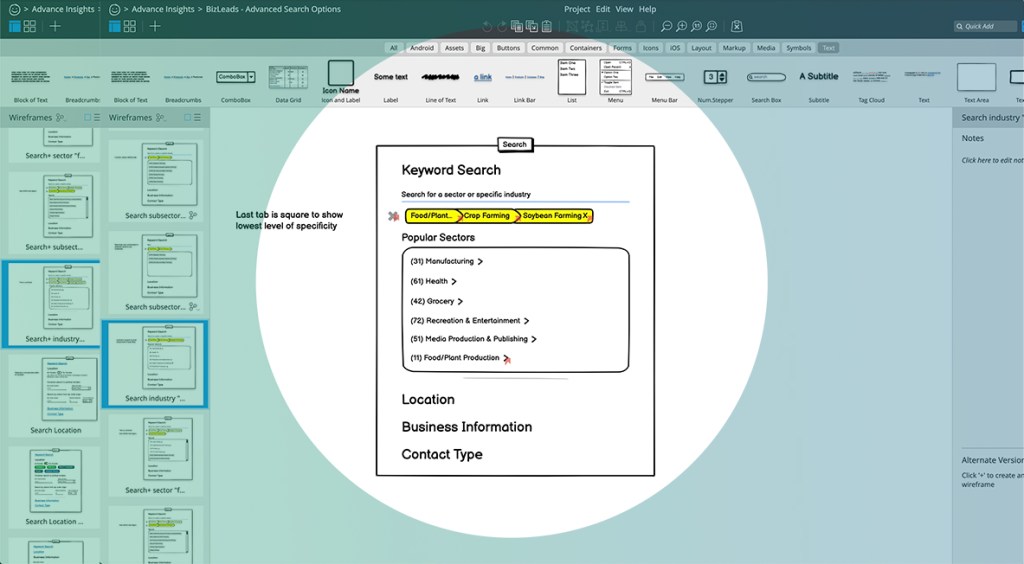

Building structure with wireframes

After establishing the details of the features we wanted to focus on I moved towards designing the UI. Beginning with wireframes, the complexity of the interactions was added as the development was specced out. These wireframes went through iterations as various paths were explored before moving on to more detailed prototyping. Development work on the back end was continuing in parallel to this process and informed how I brought visualization to the data.

.

.

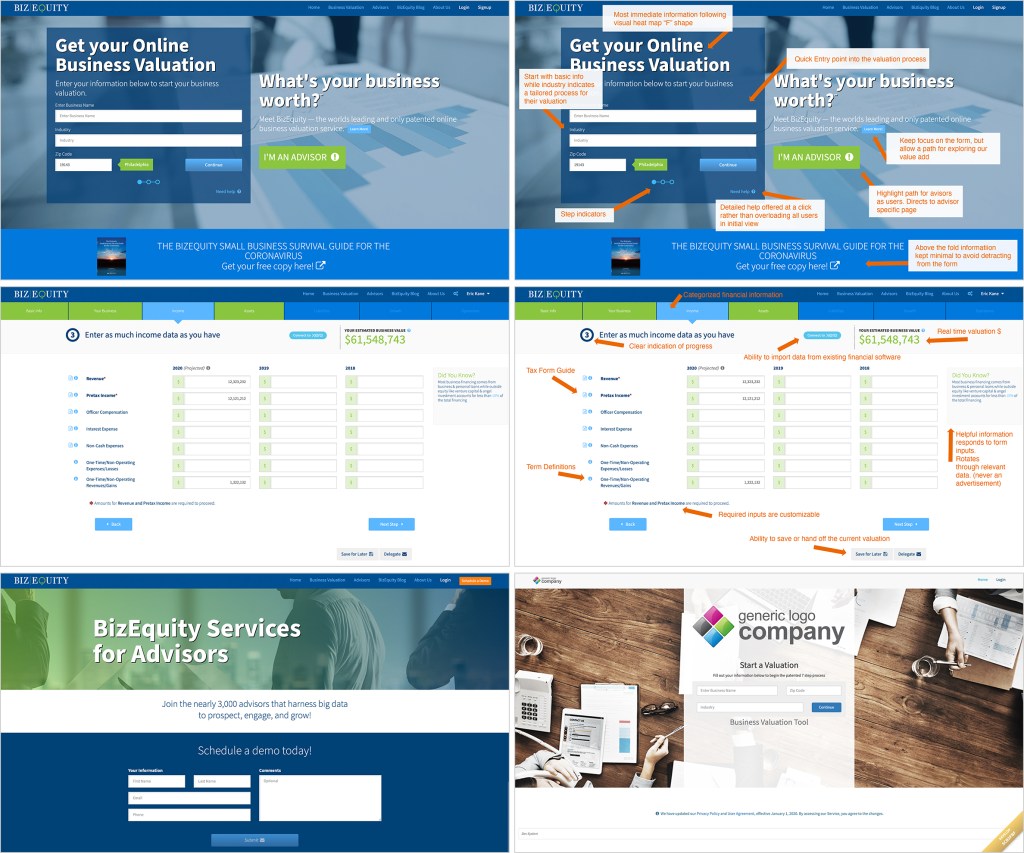

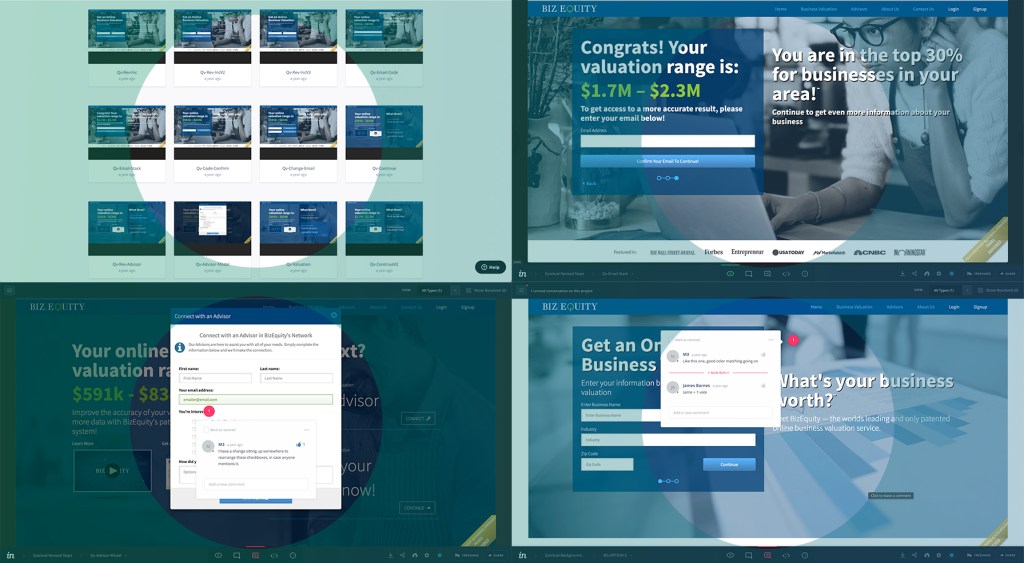

Prototyping the UI

After the wireframes were rounded out for functionality and basic UI/UX, I moved on to implementing more detailed mock-ups and prototypes in InVision. The product and development teams gave feedback. These screens were used in presentations to the CEO and stakeholders as well. This gave everyone involved a vision of the progress and shape the project and where its features were heading.

.

Solutions and Results

The end product is one that serves the needs of our distinct set of users. With an easy to follow process that gives an accurate valuation range to individuals, the small business owners have the option continue into the more complicated process for a full valuation.

We were also able to offer other paths for the small business owner is to get help from a professional, who we select from our network of advisors on our platform. Advisors are targeted with adding our valuation software to their personal offerings to their clients. Given a white-label for their advisor practice creates a portal for their clients to engage our valuation process while giving the advisor the expertise of knowing what each element of the valuation means.

The resulting implementation of these features into our business valuation SaaS app brought us to serve a greater base of users in the form of financial advisors across many disciplines. This has continued to be the basis of our business model and brings in more new client and revenue numbers than any other engagement over our entire history of offerings. It has also been successful in retaining existing clients keeping retention in the 90% range month after month.